This article was firstly published on comparehero.my

Mull over these six questions to help assess whether you are ready to make an investment:

1. Are you capable of investing right now?

With COVID-19 still rampant across the globe and the economy still in shambles due to the Movement Control Order (MCO), investors need to be frank about their own capability of investing.

For most people, having a secure income or building an emergency fund are their current top priorities. Investors must figure out if they are fit to invest before even beginning to invest.

“From my perspective, survival is the absolute priority right now. Let’s say you are in an industry where you feel the job isn’t very secure and you have loans to pay – I think someone in this instance shouldn’t just be thinking about survival but potential loss of income,” said Aaron Tang of Mr Stingy, a popular personal finance blog that covers a variety of topics, including money, time, career and relationships.

“What happens if a person’s company goes down and they’ve lost their income? I think someone in that situation is thinking about income replacement before investing, especially in today’s bad economy where people are getting laid off and shops are closing etc.,” he added.

To help cushion any unwanted circumstances during a recession, Tang said it’s crucial for everyone to prioritize building their emergency savings first, which is typically 6 to 12 months of a person’s income. “From how I see it, you need to build a very secure base first, and that comes from having a stable income. This is particularly true when investing in high risk investments,” he said.

2. What are you investing for?

Everything that we do or pursue in life usually begins with a clear objective in mind. Why do we go to school? To gain knowledge which would later help us find a job or career that aligns with our interest. Why do we find a spouse? So we can have a partner in life who we get to spend time with and build a family together. The principle applies to investing too.

Before investing, take a step back and remind yourself of the objective of your investment. Are you just eager to beat the market and make a quick buck by maximizing returns in the short term? Or is it for more personal gains like retiring, having enough to travel, buying a house or sending your kids to college?

Find out your real goal and stick to it. If it is having a certain amount of money by a certain date, then commit to that. Any decision you make while investing should be to serve that goal and nothing else.

3. What stage of life are you in?

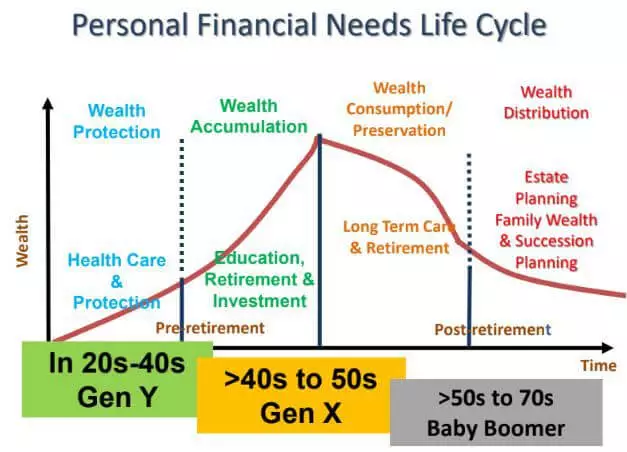

A 25-year-old fresh-out-of-college will have different financial goals and needs compared to a mid-age 35-year-old, or a retiree.

Similarly, a fresh graduate wouldn’t be able to take up the same amount of investment risk compared to an established manager who might be earning a six figure salary. Therefore it is crucial to figure out which stage of life you’re in before committing to a certain investment risk.

A person’s life stage determines their risk appetite, Phang Kar Yew, Executive Director and Co-Founder of Harveston Financial Group said, these two factors must go hand in hand in order for a person to pin down the most suitable type of investment for them.

“When you’re younger, you may afford to take the ‘fast and furious’ approach, which is to be more aggressive in the market. But I still believe that at that stage, the priority should be about wealth protection. You have to protect yourself in the event anything unfortunate happens,” Phang told CompareHero.my. “This is called investing according to the stages and lifestyle requirements.”

4. Do you understand your needs and resources?

Take some time to figure out if you actually have enough resources to invest. Purchasing a stock may not be too complicated or time consuming, but the act of planning and figuring out what and how much resources is available at your disposal is what needs more of your attention.

- How much do you currently have in savings?

- How much do you need to invest?

- How will this investment add into your overall portfolio?

- Do you have an exit strategy if things don’t work out?

- Would you need to adjust your current investments plans?

Understanding your own capacity to invest helps you go into it prepared, knowing that you are aware of your resources and limitations. You should never commit to what you’re not willing to lose.

“Maybe you did some small investments previously but didn’t have a cohesive plan to go with it, and now you want to make another big investment – that needs to be reviewed,” Phang said.

5. What is your risk appetite?

An investor’s risk appetite is sometimes a reflection of who they are and their personality – it says a lot about them as a person and what they value.

If you’re more adventurous, are aggressive and have the means, you could be more of a risk taker in the market. A conservative investor would be more risk averse, avoiding volatility and emerging industries due to their inability to estimate the returns. And risk moderates are people who sit on the fence, they observe the market and take small steps on both ends.

An investor’s risk appetite depends on where they are in their stage of life and what goal they hope to achieve from their investment (point 3).

Those eager to make a quick buck, may not want to invest in volatile markets because they could end up losing fast, too. Those in it for the long-term may consider taking up higher risk investments because it gives you a longer duration to make up for any potential loss.

“You need to first understand the amount of risk you are willing to take because there’s a lot of different types of investments. Doing this requires you to understand what type of person you are,” Tang said.

“Are you very risk averse? This means you like really safe investments that will give you slightly less percentage returns. Or are you a person who is willing to take more risks, willing to bear more ups and downs in the market. There’s no right or wrong answer as different people will be able to take up different risks,” he added.

6. Is now the right time to invest and how long will you need to invest?

There are a few time-related questions that you have to answer before starting an investment.

First, you need to figure out your duration of investment or time horizon: short-term or the long-term. The fact is not everyone invests to retire – some just want to invest for quick returns in the short-term.

Investors who are waiting out on the long-term can take up more risk because they have a longer time to recover from any potential loss. Those who do not have the same luxury of time might want to stick to less risky investments like bonds to avoid losses as it will affect your plan.

Figuring out your time horizon is also important because you need to know if you could do without the money invested. Some investments like fixed deposits won’t allow you to withdraw your money until your agreed-upon tenure has ended. This is mainly because fixed deposits offer a much higher interest rate than your average savings account, so make sure that you do not need the money before investing. Essentially, don’t put all your eggs or money into one basket or in this case, investments.

Lastly, figure out if you’re ready to invest. You might not actually be at the right stage to invest because of other commitments or the lack of time to dedicate yourself to investing.

“The responsible way to invest is to take some time to do research and understand the different products. The brutal truth is most of us may not have that level of time to go read and study so many books or articles because we are caught up with our responsibilities like taking care of our children and family etc.,” Tang said.

“Find an investment platform that makes sense for your lifestyle. For example, though I like reading about money, I don’t necessarily have time to research individual stocks, so what I do is depend on a robo advisor – there are a couple in the Malaysian market right now because it’s a very simple and convenient way to invest. That kind of product really fits in with my lifestyle,” he added. There are currently three robo advisors in Malaysia: MYTHEO, StashAway and Wahed Invest.

After you have sorted out these important questions, then you’re somewhat ready to plunge into the actual investing.

What to invest in during a recession?

Generally, when looking for stocks, investors should put their money into high-quality companies that demonstrate strong balance sheets, low debt, good cash flow and are in industries that historically have proven to do well during tough times.

At the same time, avoid highly leveraged, cyclical, speculative companies because they pose the biggest risk for performing poorly or going bankrupt.

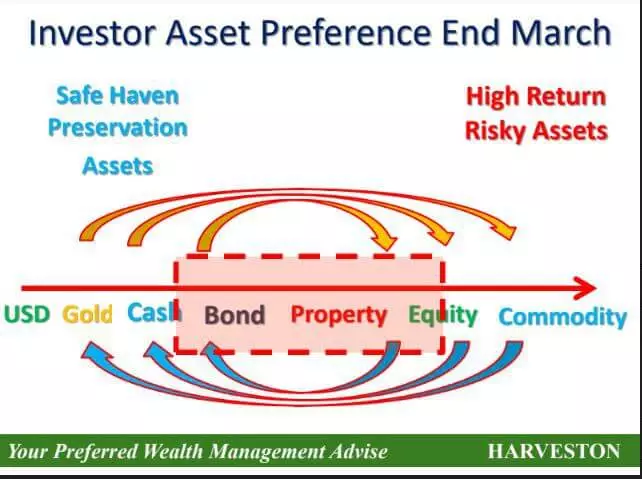

“During a crisis, a majority of people tend to focus on gold and U.S. dollars, even if the latter is seeing negative yield and zero interest rates,” Phang said. “People still (favour) U.S. dollars because of its popularity, it’s on good terms and widely used as a trade medium. People invest in gold because they feel panicked.”

But under normal circumstances, Phang said, U.S. dollars and gold may not give the highest return or value. Instead, it would be more favourable to go into bonds, property, equity and commodity.

Phang wanted to emphasize that when it comes to choosing assets to invest in, there are no set preferences. Instead, a better investment approach, he believes, is to create a portfolio based on a mix of asset classes.

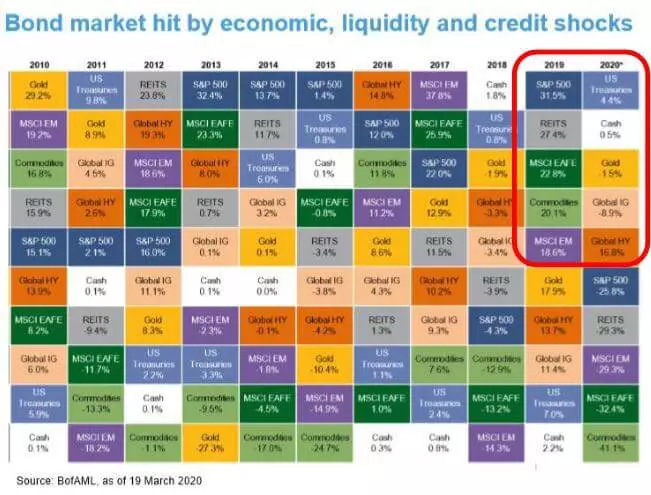

Based on historical figures and asset performances, Phang said, the S&P 500 index, U.S. Treasury securities, REITS, cash, gold, the Global High Yield Bond Fund, the Global Investment Grade, the MSCI EM index, commodities and the MSCI EAFE Index have all generally performed more consistently than other class assets. (Image source: Harveston Financial Group)

Asset classes are a group of financial instruments that have similar financial characteristics and behave similarly in the marketplace. However, different asset classes are expected to exhibit different risk and return investment characteristics, and to perform differently in certain market environments. This rationale is why diversification may be the safest strategy to take when investing.

Not happy with a certain asset class? Well, an investor’s portfolio, Phang said, is also likely to change according to the market conditions, which is largely influenced by market fundamentals, sentiment, and valuation.

Diversifying one’s portfolio based on asset allocation, Phang said, is important because no single class of assets would remain high performing in the long-term. “If you just choose one (asset) over the other, over time, you might end up losing more than earning,” Phang said.

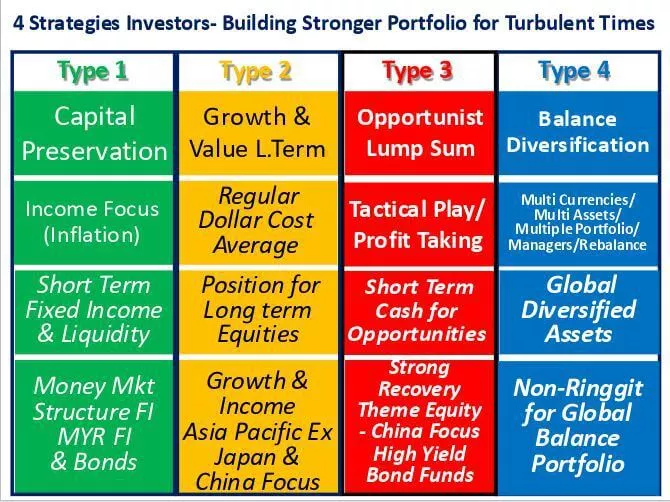

“For a balanced approach, you should understand your own asset allocation,” he said. And though there’s no winner-takes-it-all type of approach, Phang said, there are common portfolio profiles used by investors that have produced consistently high returns.

The key? To diversify based on asset allocation.

Asset allocation is essentially an investment strategy that aims to balance risk and reward by distributing a portfolio’s assets according to an individual’s goals, risk tolerance, and investment horizon, according to Investopedia.

This factor, Phang said, is where one must define their goals and time horizon, assess their risk tolerance, identify a mix of asset portfolios and create a target portfolio. Then finally select specific investments for the portfolio, before finally reviewing and rebalancing the portfolio.

To learn more, welcome to contact us at 010-209 3299 or whatsapp https://wa.me/60102093299 or pm us https://harveston.com.my/contact-us

Beware of Scam and Impersonation Using Our Company Name – Harveston Capital

Beware of Scam and Impersonation Using Our Company Name – Harveston Capital