What We Do

Our Total Wealth Planning

Harveston is on a continuous mission to ensure that every Malaysian has the right financial knowledge.

With information being literally at the tip of your fingers, it can sometimes become overwhelming and confusing. That’s where we come in.

We want to make sure that you are equipped with the right knowledge and information about personal finance and wealth planning. Wealth Management is not just purchasing an insurance plan for you and your family. It’s beyond that, and it encompasses several pockets of financial management.

Harveston is here to make your experience a breeze, with a peace of mind.

Personal and Family Wealth Management

Corporate Wealth Management

Whatever product or service your business provides, a financial advisor can ask the right questions and find the right answers to make your life easier. We help make your business more efficient and more profitable by focusing on the actions that will get results.

As a Financial Advisory company, Harveston doesn’t only focus on individuals and SMEs, but we’re also capable of preparing big corporations to manage their wealth in various areas.

How We Do

Our Client Experience

Our Core Values

1. Independent Advice

a. Our advice is based on clients’ needs.

b. We represent our clients’ interests to seek the most suitable solutions.

2. Customized & Integrated Solutions

a. We implement customized solutions at the different stages of our clients’ lives.

b. We provide integrated multiple solutions to achieve our clients’ financial objectives.

3. Team-Based Approach

a. We serve our clients with a pool of expertise in various areas of Wealth Management Services.

4. Professionalism

a. Our advisers are qualified and well trained in all aspects of Wealth Management Services.

b. We uphold our practice standard by benchmarking the industry best practice.

Our Process

Step 1 - Client Exploratory and Engagement Process

Step 2 - Fact finding and gather client information

Step 3 - Analyzing client data, planning objectives, executive summary

Step 4 - Presentation of executive summary

Step 5 - Solution implementation

Step 6 - On-going review and monitoring

Career

Join Us

Financial Adviser

Why Choose Harveston

Independent Advice

1. Our advice is based on clients’ needs

2. Fees-based advisory allow adviser to give the best advice to client

3. We are unbiased to any products or business partners

Customised and Integrated Solution

1. We implement customized solutions at the different stages of our clients’ lives.

2. We provide integrated multiple solutions to achieve our clients’ financial objectives.

3. We represent our clients’ interests to seek the most suitable solutions.

Professionalism

1. Our advisers are qualified and well trained in all aspects of Wealth Management Services via our in-house structure practise management training programme

2. We uphold our practice standard by benchmarking the industry best practice

3. Latest market outlook and financial update

Team-Based Approach

1. We have a pool of expertise in various areas of Wealth Management Services to provide technical support

2. We have a series of Marketing and Activities to allow adviser to approach prospect or stay in touch with clients

3. We have centralised operation and adviser portal system to facilitate daily administration operation

Employment

JOIN OUR HARVESTON FAMILY!

We’re seeking bright, vibrant and passionate individuals to join us on our journey to becoming the preferred wealth management firm in Malaysia.

Harveston is one of the leading wealth management firm in Malaysia, where we commenced our business since 2009.

At Harveston, we emphasise on our people - helping them grow, expanding their abilities and discovering new opportunities - simply because it makes them happy. We understand that in essence, when people are happy, they will develop their careers with wholehearted enthusiasm and support our business with genuine interest, focused strength and great ability, thus pleasing our customers and keeping them happy.

Our Expertise & Skills to All Business

when an unknown printer took a galley of type and scrambled make a type specimen book.

Our Expertise & Skills to All Business

when an unknown printer took a galley of type and scrambled make a type specimen book.

Our Team Member

Our Expertise Will Help You

It has survived not only five centuries.

Summer Tan Jia Xin

Regina Tan Mei Ling

Sally Khoo Sa Li

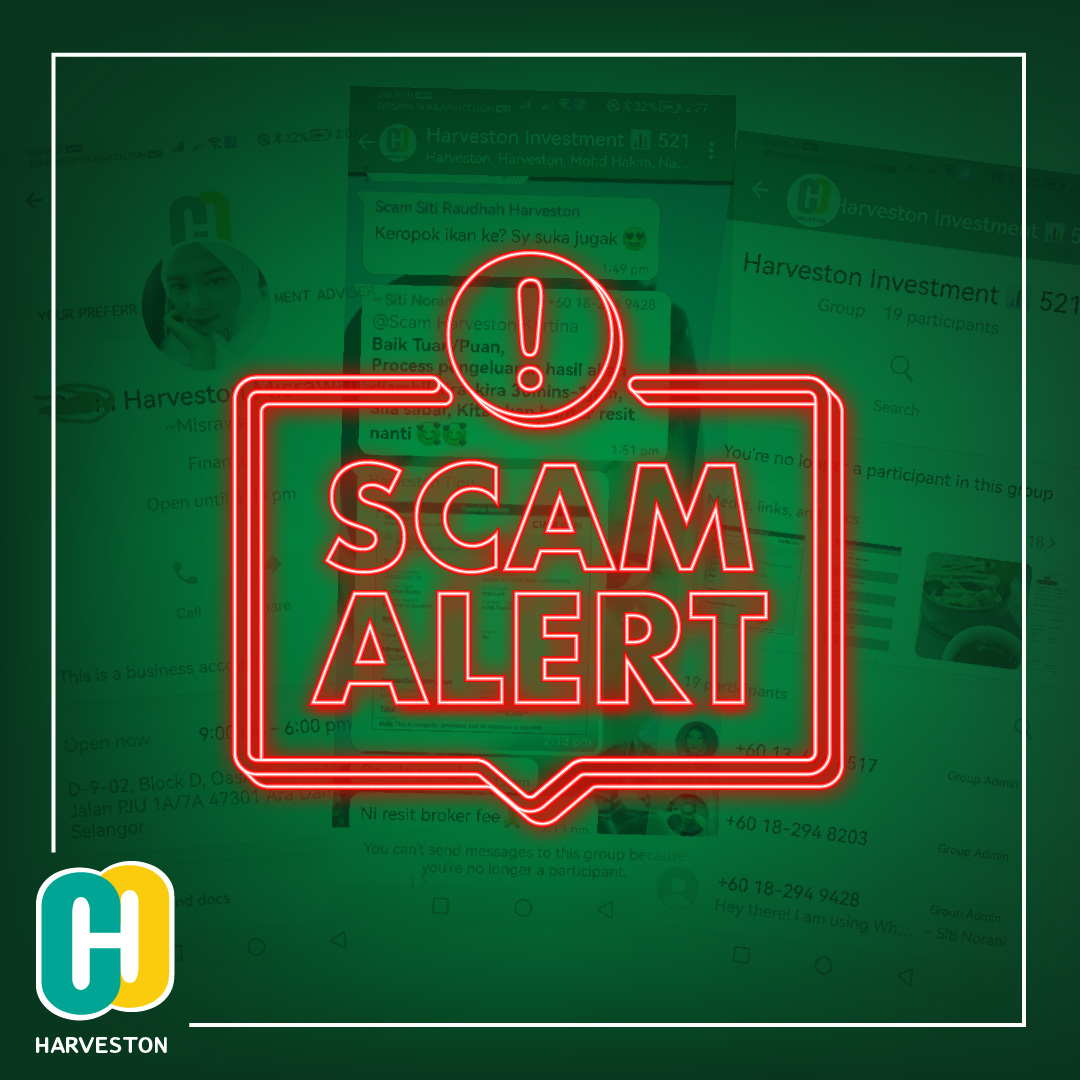

We would like to bring to your attention that the name Harveston is being used for fraudulent purposes. We have received reports that scammers are using our name to deceive people and engage in misleading activities.

We would like to bring to your attention that the name Harveston is being used for fraudulent purposes. We have received reports that scammers are using our name to deceive people and engage in misleading activities.