This article first appeared in Malay Mail Online, on April 1, 2017

KUALA LUMPUR, April 1 ― Finance Minister II Datuk Seri Johari Abdul Ghani’s suggestion that Malaysians put off home ownership to avoid long-term debt is valid advice, according to a wealth advisor.

Financial advisory firm Harveston’s Annie Hor, who concurred with the minister, also added that Malaysians who buy homes before they are financially ready may not be aware of the total cost of home ownership.

“Maintaining a property can be a concern when the house starts to show signs of aging and you have no funds to fix them,” she told Malay Mail Online.

While it was ideal to be able to comfortably afford property, Hor said it was safer to save up on cash if buying a home risked leaving an individual with negative cash flow.

Paying off a mortgage early without accumulating sufficient cash for retirement could leave such buyers “asset rich, cash poor” during a time in their life when they may no longer have a reliable source of income, she said.

Hor said Malaysians who make “just enough” each month should seek expert advice before committing to buying a home, in order to avoid the situation she described.

Proper financial planning was also beneficial for those already with mortgages, as this could help determine if they are “sacrificing” savings and long-term investments in the rush to pay off their home loans, she added.

“Plus, with Malaysians having an average of RM50,000 in their EPF account after retirement, it is better to consider some financial strategies so there is enough cash for emergencies later on,” Hor said.

Last year, the Employees Provident Fund (EPF) said over 60 per cent of Malaysians have less than RM50,000 in mandatory retirement savings, well below the recommended RM228,000 needed to last at least 20 years.

Speaking at a dialogue session for the Transformasi Nasional (TN50) vision, Johari said Malaysians were diving into property ownership prematurely due to the stigma that surrounds renting in the country.

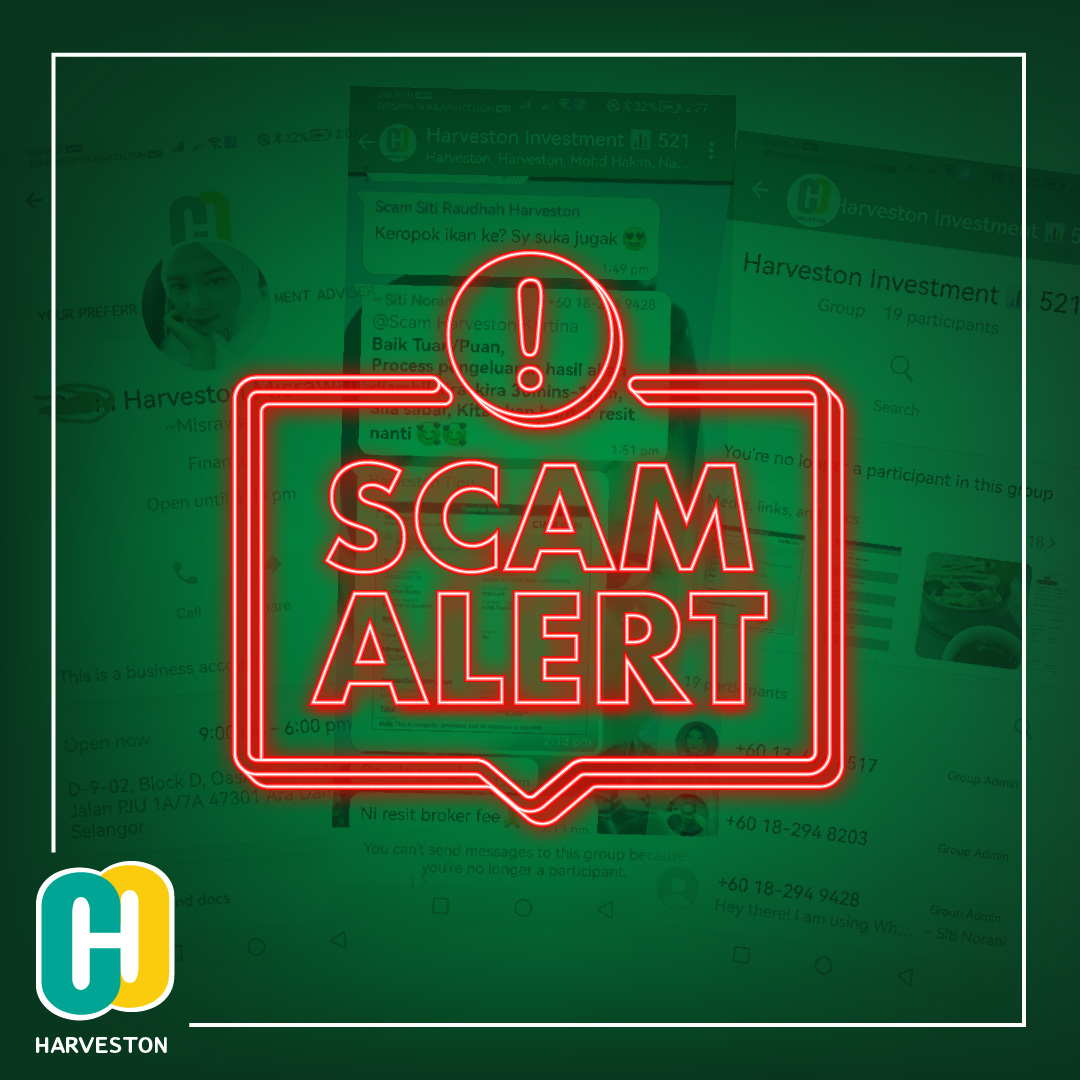

Beware of Scam and Impersonation Using Our Company Name – Harveston Capital

Beware of Scam and Impersonation Using Our Company Name – Harveston Capital