This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on April 4 – 10, 2016

Malaysian women have made great strides in financial and retirement planning over the past few decades, but more needs to be done. According to HSBC’s report on the

Future of Retirement: A Balancing Act, released on March 18, many Malaysian women (69%) are unable to save enough for a comfortable retirement because of their more pressing financial obligations, such as mortgages and other debts.

Annie Hor, a financial planner with Harveston Financial Advisory Sdn Bhd, says while she has observed a heightened awareness of financial planning among Malaysian women in general, those who are single and below 30 tend to be less concerned about their financial situation.

“Many married men leave the financial matters to their wives, such as paying the household bills or their children’s education. Hence, women have become more empowered and are looking into financial planning not just for themselves but also their spouse,” says Hor.

Single women who are already in their thirties tend to take more ownership of their overall finances, she adds. “When you are single, you really have to depend on yourself and ensure that there is no gap in your planning.”

But those who are younger tend have a different attitude towards financial planning, says Hor. “If their family have not gone through tough times, they tend to adopt the YOLO (you only live once) attitude because they believe that everything will be taken care of. They only take financial planning more seriously after they turn 30. When they start seeing their peers buy houses and other assets, they will start thinking: ‘What am I doing with my life? Am I accumulating wealth?’”

In the light of the challenging economic landscape, financial planning has become more critical than ever. Financial planners offer advice on what young women can do to cultivate healthy financial habits.

Create an emergency fund

Lim Yan Chang, personal finance coach and director of Wings Alliance Sdn Bhd, advises women investors to have at least six months’ worth of expenses in their savings, or up to 24 months if they are able to, before jumping into any kind of investments. The savings can act as a buffer in the event that they lose money in the short term, he explains.

“You don’t want to lose sleep if the prices of the stocks you hold go down. That is very unhealthy. So, let’s say you need RM3,000 a month to survive. For six months, that is RM18,000. When you have this amount in your savings, you can start thinking about investments,” says Lim, adding that while breadwinners may not be able to save 24 months’ worth of expenses, single women with no dependants should have no problem saving that amount.

Hor says women investors should have at least three months’ worth of expenses in their emergency fund. This is very important, especially in the light of the current volatile economy. The fund can help them cope with investments that are not giving any returns yet or deal with any unforeseen events.

“For example, your family members need urgent financial help, or your house needs major repair works all of a sudden, or if your car breaks down and needs to be overhauled. This is where the emergency fund kicks in, so you don’t have to touch your investment funds,” Hor says, adding that they may also need to review their emergency fund allocation once every few years as their monthly expenses increase.

Hor recommends that her clients keep their emergency fund in fixed deposits so that they can lock it in and still get a decent return. If they have a housing loan, they can opt for a capital pre-payment.

“Let’s say I owe the bank RM500,000 and my monthly instalment is RM2,000. My emergency fund is RM50,000. If I put that in fixed deposits, it gives me only 3%. But if I put that in my housing loan, the interest rate is 4.5%. So, I can effectively reduce some interest there. If I need to use the money, a capital pre-payment allows me to withdraw anytime, but with a charge,” she explains.

Investing habits

Is there any difference between how men and women invest? Lim says that based on his experience, men tend to be a bit more gung-ho in investing to get higher returns over the short term, while women tend to play safe and expect less returns on their investment.

“Women tend to stay away from risky investments. They tend to want things that are more predictable and less aggressive. While men may want 12% or 15% returns, women prefer investments that give them 5% or 6% returns,” he says.

Hor says the reason women tend to invest for the longer term is that they are objective driven. “Generally, when male clients come to see me, they want something that can give returns in two to three years. It is quite hard to invest in such a short-term period. Actually, they don’t need the money immediately. They just feel like they want a short-term deal.

“Women are more patient and have long-term objectives — for example, their retirement or their children’s education. They don’t feel the urgency to see returns [within a short time frame].”

Women should be a bit more aggressive in investing if they want to outlive their money, says Hor, adding that this is particularly true for those who are single. “However, you should not invest aggressively if you will constantly worry about it and call your financial planner every night. You also cannot take risks just because your planner or someone else tells you to. Instead, you need to assess your risk appetite [and invest] accordingly.”

When it comes to investment options, Hor says property is recommended, provided that the investor is able to manage the upkeep. “There are lots of independent women who are more willing to do it than men because they are willing to put up with the hassle of collecting rent, calling tenants and making sure the house is in a proper condition. It is a very good investment if they are in it for the long run.”

Hor recommends that women investors hold shares that can be easily liquidated. “Let’s say you decide that you want to sell your property for your child’s education. But when the time comes, what if the market is soft and you are not able to find a buyer straight away? You cannot tell your child to postpone his studies [so you have to find another way to get the funds]. So, it is good to invest in unit trust funds or liquid shares.”

Hor says while women may feel inclined to own gold, it does not give a good return. “Women love to buy gold jewellery. There are also people who buy gold to pass it on to the next generation. However, gold jewellery is not a good investment. If the design is outdated, they will have to sell it to the [jewellery] shops, which will slash 20% off what it is worth. Gold can be used to hedge against inflation, but it is not a good investment.”

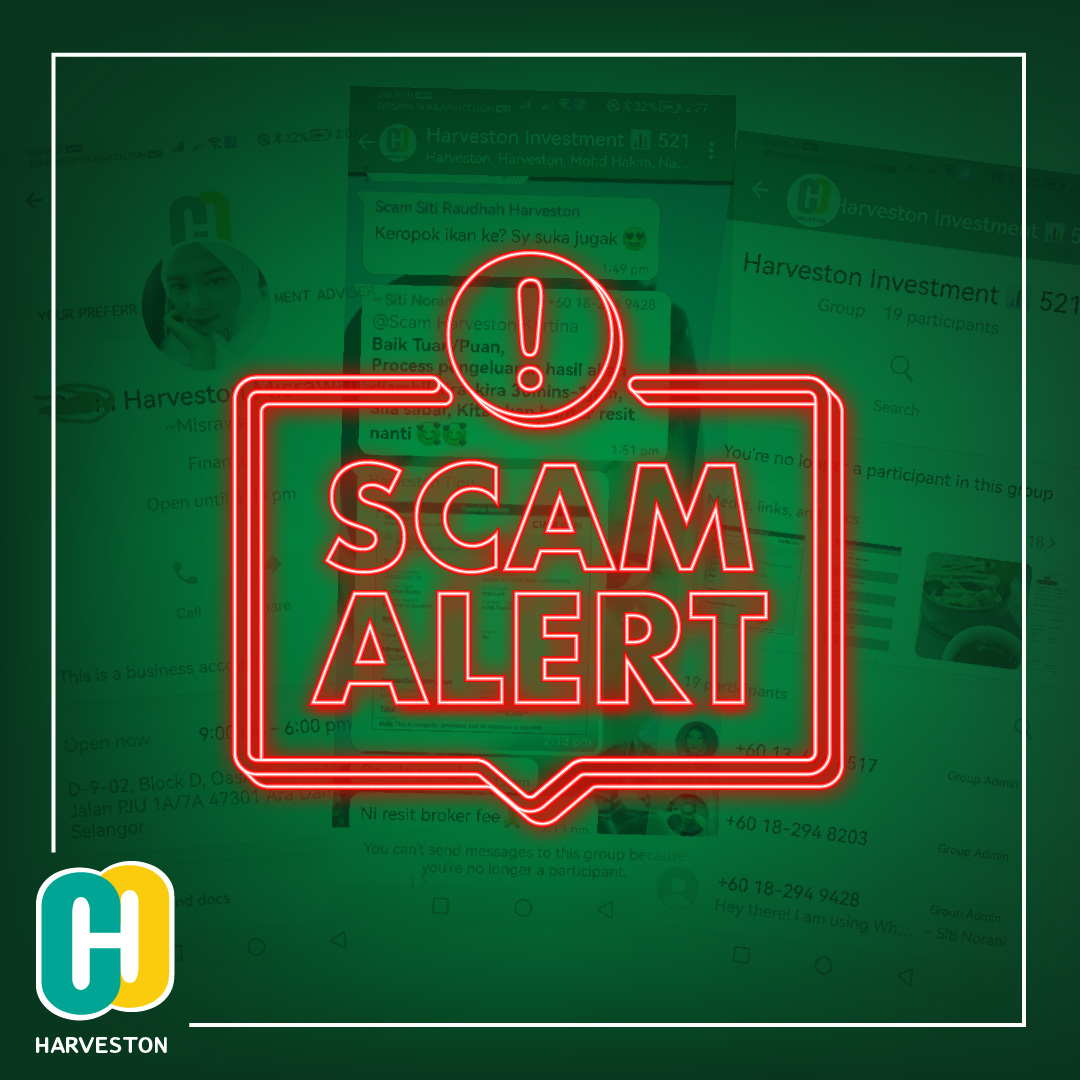

Beware of Scam and Impersonation Using Our Company Name – Harveston Capital

Beware of Scam and Impersonation Using Our Company Name – Harveston Capital